Zuckerberg has recently shared pictures of himself in a hospital bed, causing concern among fans and showing that he underwent quite a serious surgery. The Instagram post doesn’t provide details about the cause and timing of the surgery, but the billionaire did reveal that he had to give up something significant because of this medical procedure.

He really made jiu-jitsu a big part of his life, just like his business “stuff”.

Mark Zuckerberg’s unexpected foray into Brazilian jiu-jitsu has sparked widespread interest, shedding light on a facet of the tech magnate that extends beyond the digital realm. The co-founder of Facebook, set to reach the milestone of 40 years in May 2024, unveiled his newfound passion for martial arts that took root in August 2022.

Beyond the confines of Silicon Valley and the tech domain, Zuckerberg seems to have discovered an alternative arena where he can challenge himself and partake in a mode of self-expression that transcends the world of code.

The choice of Brazilian jiu-jitsu, a martial art known for its emphasis on technique and leverage, reflects Zuckerberg’s inclination towards a discipline that demands not only physical prowess but also strategic thinking. It’s a departure from the stereotypical image of a tech titan, underscoring the multifaceted nature of individuals and their pursuits.

“To some degree, MMA is the perfect thing because if you stop paying attention for one second you’re going to end up on the bottom,” the CEO of Meta said.

He is also a champion.

In a surprising turn of events at his inaugural Brazilian jiu-jitsu tournament in Redwood City, California, Zuckerberg achieved remarkable success by clinching gold and silver medals. This unexpected triumph sent ripples through the martial arts community, garnering attention and admiration from a broader audience.

Zuckerberg took to social media, particularly Instagram, to share the exhilarating news with his vast following of 11.3 million. Accompanying the announcement were captivating photos capturing moments of victory, as he posed alongside his coaches and engaged in ground battles with formidable opponents.

In his Instagram post, Zuckerberg humbly captioned the achievement, stating, “Competed in my first jiu-jitsu tournament and won some medals,” accompanied by emojis depicting a gold and silver medal. He graciously acknowledged the crucial role of his three trainers, tagging them in the post and expressing gratitude for their guidance.

Mark even put an octagon in his garden, and his wife was not very happy about it.

Mark Zuckerberg has taken his martial arts training to the next level, and it seems like it’s causing a bit of a stir at home. The Facebook and Meta founder recently revealed on social media that he installed a fighting cage, a UFC octagon, in his backyard. His excitement was evident as he shared a screenshot of his conversation with his wife, Priscilla Chan, asking if she had seen the new addition and commenting on how awesome it looked.

However, Chan’s response was less enthusiastic. She mentioned that she had been working on the grass in the backyard for two years, indicating that the sudden appearance of a fighting cage wasn’t exactly part of her landscaping plans.

Not one to shy away from public opinion, Zuckerberg decided to let his followers have a say in the matter. He posted a poll, asking whether he should keep the cage or prioritize preserving the grass.

This unconventional backyard setup is not just a personal whim but seems to be connected to the ongoing banter between Zuckerberg and Tesla founder Elon Musk. The two tech titans have been playfully challenging each other to a cage match, with Musk even suggesting that their fight could be live-streamed on X, with all proceeds going to charity for veterans.

In the midst of this lighthearted exchange, Musk shared that he’s preparing for the showdown by lifting weights throughout the day, showcasing a commitment to the bout that goes beyond mere words.

As the anticipation for this unconventional clash between tech giants builds, it’s clear that for Zuckerberg and Musk, this fight is more than just a physical contest, combining competition with a charitable cause.

An unexpected injury resulted in him missing a crucial competition.

Zuckerberg has recently undergone surgery following an ACL injury that occurred during mixed martial arts (MMA) training. The co-founder of Facebook shared this information through an Instagram post, where he mentioned, “I tore my ACL (anterior cruciate ligament) sparring and just got out of surgery to replace it.”

In the post, Zuckerberg also disclosed that he had been training for a competitive MMA fight scheduled for early next year but acknowledged the delay caused by the injury. Despite this setback, he expressed optimism, stating, “Still looking forward to doing it after I recover.” The Instagram post included several photos taken at an undisclosed hospital, capturing moments before and after the surgery, with his wife Priscilla Chan offering support during the recovery process.

Priscilla Chan was there every step of the way, wiping Mark’s forehead and helping him with his slides after his recent surgery. It’s a touching testament to the unwavering support and care she brings to their marriage. Their connection goes beyond the challenges, resonating in their love for their children and their shared commitment, even to tasks as humble as being janitors.

Mark and Priscilla’s promise of an annual honeymoon is a simple yet powerful tradition that underscores their dedication to keeping their relationship strong amid the hustle of their busy lives.

This story isn’t just about Zuckerberg’s surgery or their unique honeymoon ritual. It’s a peek into the personal lives of influential figures, revealing universal themes of love, commitment, and the crucial role of being there for each other through thick and thin. It’s a reminder that even tech giants have personal moments that reflect the fundamental aspects of human connection.

Mark Zuckerberg is a true fighter in real life, just as he battled to win his wife’s heart and make her fall in love with him.

Preview photo credit zuck / Instagram

Priest Conducting Funeral Service for Wealthy Woman Leaned over Her Coffin – He Was Stunned to the Core by What He Saw

When Father Michael is conducting a funeral service for a woman, he notices an oddly shaped birthmark on her neck, exactly like his own. What comes next is a journey of self-discovery through the grieving process. Will Father Michael get the answers he so desperately wants to find?

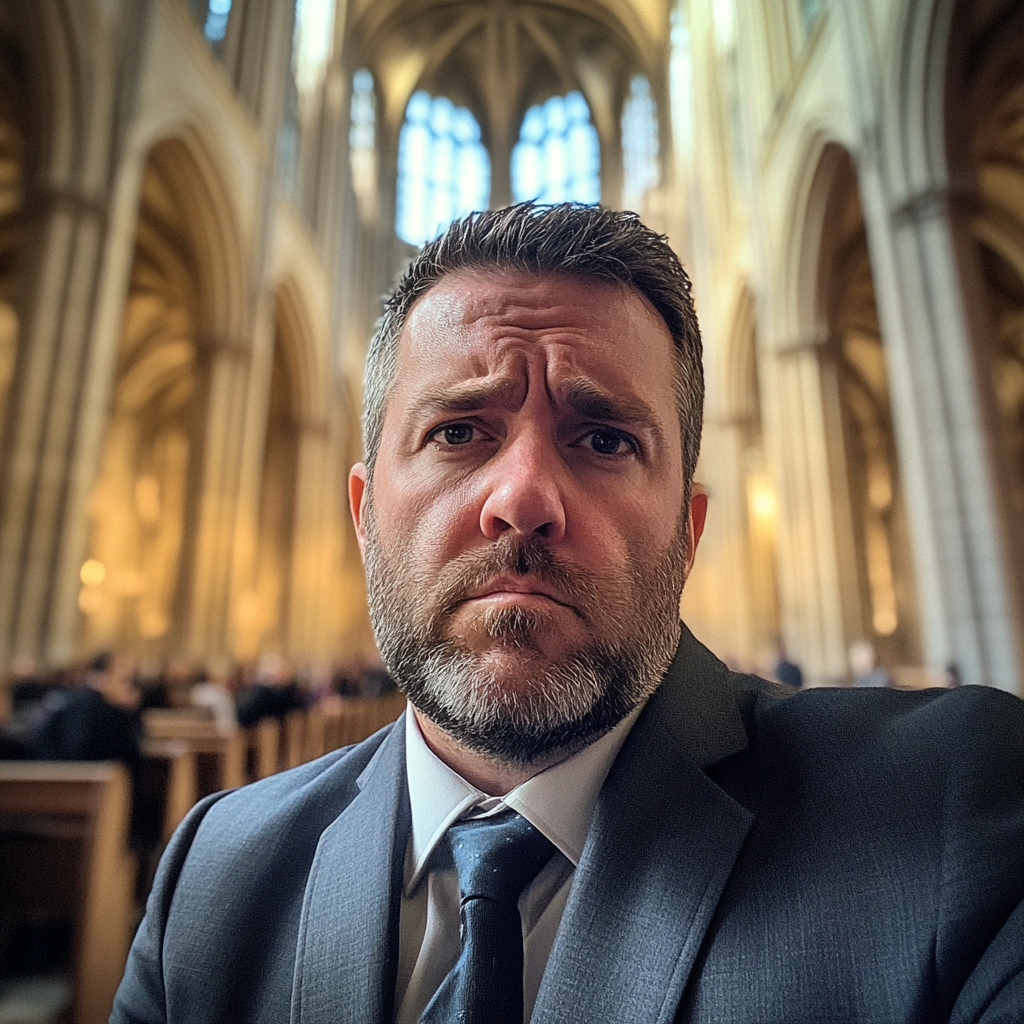

The cathedral was silent, veiled in the heavy air of loss. Shadows from towering candles flickered along the marble floor as mourners dressed in black filled the pews, their heads bowed in reverence.

A funeral in a cathedral | Source: Midjourney

Eleanor, known throughout the community as a generous but reserved woman, had left behind both a sizable fortune and an enduring mystery.

Father Michael took a deep breath, the weight of yet another funeral pressing on him as he approached her casket. He’d never met Eleanor in person, yet something about her presence had always seemed familiar, almost hauntingly so.

As he moved closer, a strange compulsion stopped him. It was something that he couldn’t explain.

A priest in a cathedral | Source: Midjourney

He paused, then leaned in, bowing his head to begin the prayer. But as he did, his gaze drifted to her neck, and he froze.

Just behind her ear, a small, purplish birthmark stood out against her pale skin. It was almost shaped like a plum, the same shape and color as the one he had carried his whole life.

“How?” he muttered. “What does this mean?”

A woman in a casket | Source: Midjourney

A chill shot through him, his hand reaching up to press against his neck. He was well aware that everyone was looking at him, but still, he couldn’t help himself.

This is impossible, he thought.

His heart hammered as memories flooded him, half-forgotten sounds and incidents from his years in the orphanage, from the searches for any record of his parents. The longing he’d held onto for so long stirred within him, demanding answers.

A little boy standing in a room | Source: Midjourney

Is there a connection between Eleanor and me? he wondered.

After the service, as the organ played its final verse, the mourners began to disperse, and Father Michael approached Eleanor’s children. They were all clustered near the altar, as her daughters decided who was taking home the floral bouquets.

His request hung on his lips like a prayer he wasn’t sure he was ready to speak.

A close up of a priest | Source: Midjourney

“I’m sorry for interrupting,” he said. “But I… I need to know something.”

“Of course, Father,” Jason, the youngest son, said. “Whatever you need.”

“I just wanted to know if there’s any chance that Eleanor… if she might have had a child. Another child, I mean. Years ago. Many years ago?”

Eleanor’s eldest son, Mark, frowned deeply, exchanging a wary glance with his siblings.

A frowning man | Source: Midjourney

“I’m sorry, Father, but what are you saying?” he asked. “Do you know something we don’t?”

“Did our mother come to you in confidence? Was there a confessional?” one of the daughters asked.

Father Michael took a deep breath and swallowed his nerves.

A close up of a priest | Source: Midjourney

“I don’t know,” he said, looking at Mark. “And no, your mother didn’t come to confessional. But I have reason to believe that it is true… If… if I could request a DNA test, just to put this to rest, I would be grateful.”

A wave of discomfort swept over the group, some of them shifting uncomfortably. Mark’s face hardened, skepticism clearly written all over.

“With all due respect, Father, this sounds preposterous. Trust me, our mother was an upstanding woman. She would have told us if something like this were true.”

A woman looking surprised | Source: Midjourney

Father Michael shifted on his feet.

“I understand that,” he said. “It’s just that Eleanor could have had her child very young, and while she wouldn’t have done anything wrong by allowing that child to be adopted, the child still exists.”

Father Michael knew he was speaking as a priest, but he couldn’t turn it off. He had been trained to speak softly and objectively. And even now, he didn’t know how to fight for this DNA test.

A priest looking uncertain | Source: Midjourney

Instead, he nodded and began to back away before anything else happened.

“Wait,” Anna, Eleanor’s youngest daughter, said. She stepped forward, her gaze soft as she studied him.

“If you believe that it could be true, then I’ll do the test. I’d want answers, too. Are you the child?”

“I could be,” Father Michael said. “It’s that birthmark on her neck. I have it, too. And when I was at the orphanage, the old woman who was in charge of the kitchen said that all she could remember of my mother was the birthmark on her neck.”

A smiling woman | Source: Midjourney

A week crawled by, and each day, Father Michael found himself tossing in his bed as he imagined what it would mean if it were true. Then, one morning, an envelope arrived at the rectory. He tore it open, barely able to see through his shaking hands as he read the results.

It was a match.

Days later, Father Michael sat alone in the rectory. Since the results had come out, he had visited Eleanor’s family, hoping they would be willing to listen now the results were concrete information.

DNA testing | Source: Midjourney

Eleanor’s daughters, his half-sisters, were ready to welcome him into the family, but the brothers didn’t want anything to do with him. It was as though having a new “big brother” was too threatening for them.

He didn’t know what else to do. He wasn’t going to fight for a way into their lives and their family. He wasn’t going to push himself in. But it did help that he knew where he belonged now.

Except… the one person with all the answers wasn’t around anymore.

A priest sitting in a cathedral | Source: Midjourney

“Father Michael?” an elderly woman’s soft voice brought him back to the present. “I’m Margaret, a friend of your mother. I was Eleanor’s best friend. Her daughter, Anna, told me everything when I went to have tea with them.”

“How can I help you?” he asked.

Her words struck him like a blow. Your mother. He motioned for her to come in, barely able to speak as they settled into chairs across from each other.

An elderly woman standing in a doorway | Source: Midjourney

Margaret took a deep breath, her eyes misting over.

“Father,” she said. “Eleanor and I were close, closer than sisters, even. She told me things that no one else knew.”

He leaned forward, his heart pounding.

“Please, I need to know everything. I spent my entire life wondering where I came from.”

A priest sitting in an office | Source: Midjourney

Margaret gave a sad smile.

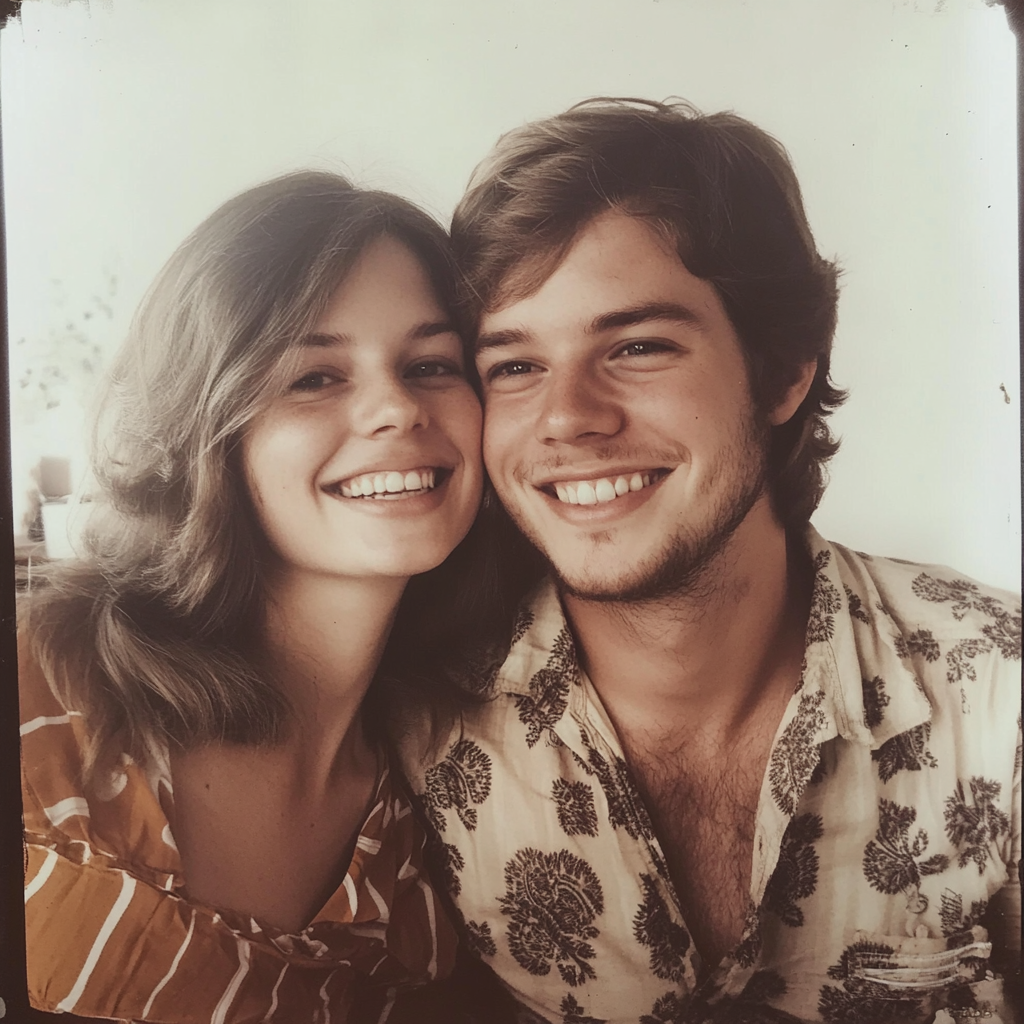

“She was always so careful, our Eleanor. Always afraid of what people would think. But one summer, she met a man, a traveler, a free spirit. He was very different from who we were back then. And she said that he was like no one she’d ever met.”

Father Michael closed his eyes, imagining his mother as a young woman, full of life, swept away by the prospect of love. He didn’t speak; he was afraid that if he interrupted, the truth would slip through his fingers.

A smiling young couple | Source: Midjourney

“She didn’t even tell me at first,” Margaret continued. “When she found out she was pregnant, she was terrified. Her family had expectations. A child born out of wedlock would have ruined her. So, she concocted this story, and she told everyone that she was leaving for the North Pole, studying penguins of all things.”

The old woman chuckled and sighed.

“I thought it was absurd, but she left. She had you in secret and arranged for you to be taken to the orphanage.”

A pregnant woman holding her belly | Source: Midjourney

Father Michael’s throat tightened, emotions too tangled up to unravel.

“She gave me away to protect her reputation?” he asked.

“Oh no, Father,” she said. “It wasn’t about reputation, it was about survival. Eleanor loved you. I knew that. She would check in at the orphanage from time to time.”

“She asked about me?” he asked.

The exterior of a building | Source: Midjourney

“Oh, yes,” Margaret said, smiling. “She kept track, as best she could. She couldn’t be in your life, but she made sure you were safe.”

Father Michael’s heart ached.

“I spent my life thinking that she’d abandoned me. And all this time, she… she was watching from a distance?”

A smiling older woman | Source: Midjourney

“She didn’t forget you. It broke her heart, Father. She loved you in her own, quiet way. She just had to do this because it was either this or… who knows what your grandfather would have done.”

She’d loved him, even if he’d never felt it, even if she’d never told him herself.

In the weeks that followed, Eleanor’s family decided to embrace Father Michael with cautious but open arms. Anna became a steady presence at the rectory, often stopping by with scones or muffins and ever-ready to fill him in on family stories, recounting memories of Eleanor.

A basket of muffins | Source: Midjourney

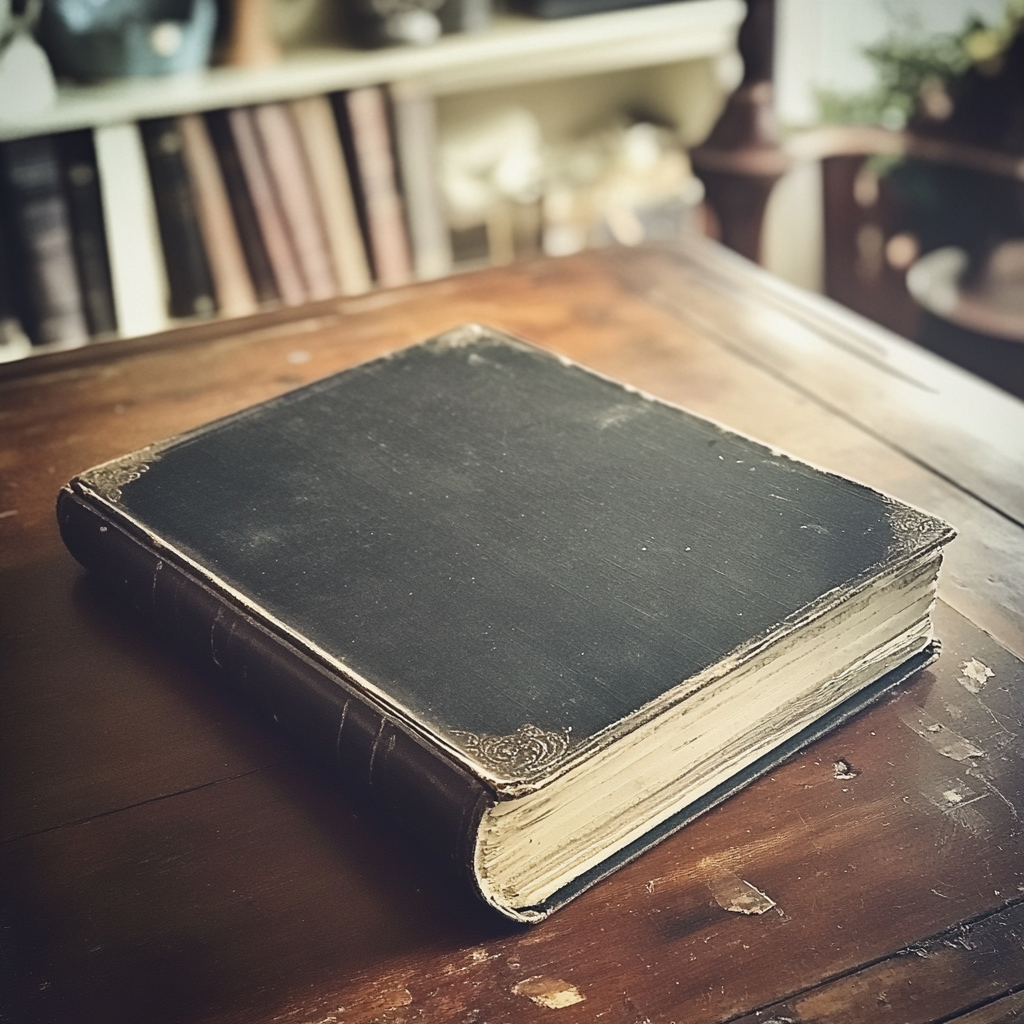

One afternoon, as Father Michael sat in his office, Anna came by with a small, worn photo album.

“I thought you might want this,” she said, placing it in his hands. “It’s… all the photos we have of Mom. Maybe they’ll help you piece her together.”

An old album on a table | Source: Midjourney

The next day, Father Michael found himself at Eleanor’s grave.

“I forgive you,” he said. “And I thank you for watching over me.”

Flowers on a grave | Source: Midjourney

If you’ve enjoyed this story, here’s another one for you |

A Homeless Man Approached Me and Showed Me a Birthmark on His Neck Identical to Mine

I never imagined a quick lunch break would lead me to the man who might be my father — a homeless stranger with the same birthmark as mine. As we wait for the DNA test result that could change everything, I can’t shake the feeling that my life is about to take a turn I never saw coming.

I stepped out of the office, loosening my tie as I hit the street. The sun was glaring, and the city buzzed around me, but all I could think about was grabbing a quick bite before my afternoon meetings. Work was nonstop these days, but that’s what comes with the territory. I’ve worked too hard to get here to complain now.

Man walking in the city | Source: Pexels

Growing up in that old trailer with Mom, life wasn’t easy. We didn’t have much, but she made sure we had enough. Mom, Stacey, was a force of nature.

This work is inspired by real events and people, but it has been fictionalized for creative purposes. Names, characters, and details have been changed to protect privacy and enhance the narrative. Any resemblance to actual persons, living or dead, or actual events is purely coincidental and not intended by the author.

The author and publisher make no claims to the accuracy of events or the portrayal of characters and are not liable for any misinterpretation. This story is provided “as is,” and any opinions expressed are those of the characters and do not reflect the views of the author or publisher.

Leave a Reply