With her public announcement of her cancer diagnosis, Catherine, Princess of Wales, put an end to the many theories and conjectures that had been making the rounds in the media ever since her scheduled abdominal surgery.

She stated in the video that tests performed by the doctors after her surgery revealed the malignancy. She went on to say that before telling the public, she and William needed some time to break the news to their kids.

Royal analysts surmise that Kate had a purpose in releasing the film on Friday at 6 p.m., as their kids’ school had already ended and they wouldn’t be confronted with inquiries about it right away from their peers.

A palace source told the Times, “George is ten now and can’t be shielded from any of this now.””He won’t be able to avoid it once it’s in the school playground and at the school gate.”

Grant Harrold, the former butler of King Charles, claims that when Kate and William informed the kids about her disease, they approached each child differently. He thinks that when they told Prince Louis about her health problems, the couple probably “sugarcoated” them.

Grant Harrold told the NY Post, “I’m sure it was a very difficult and very different conversation between children.””I’m sure the conversation with Louis was more sugarcoated than it was with George and Charlotte, for example.”

“The older children can understand more, so I’d imagine it was a little more frank but undoubtedly staying positive, which is so important,” the former butler went on.

This explains why you now cry when you see the photo of Kate with her three kids. It’s important for any mother to have that talk, and you can bet Charlotte and George will be there to support her.

Louis is too little to comprehend her mother’s situation, he continued.

It’s a challenging one. He told the NY Post, “I’m sure the kids will handle it as any kids would be expected to handle it, but I think that will rub off on the kids because their parents are very good at being calm and collected.”

The kids will spend Easter break with their parents at Anmer Hall on the Sandringham Estate, where they may go egg hunting and have fun.

Easter Sunday mass will probably be attended by King Charles and Queen Camilla, but not by the family.

Danielle Stacey, the royal expert for Hello! Magazine, stated, “It’s understood that King Charles may attend a church service on Easter Sunday with a smaller royal turnout if his health allows it.”

“As he continues his cancer treatment, Charles has minimized his contact with larger crowds to reduce risks,” the spokesperson added. “The King has performed for small audiences at Buckingham Palace, but he hasn’t gone to any major events since receiving the diagnosis, like the Commonwealth Day service, the Korean War Veterans’ reception last week, or the late King Constantine’s memorial in Windsor last month.”

About 110 miles outside of London is the Norfolk country estate known as Anmer Hall, where the Princess of Wales is believed to feel “most at home.”

She previously stated that she is happiest “outside in the countryside with my family.”

She would be creating Easter cakes with the kids, and they would be decorating them with Cadbury eggs.

Three years ago, it was said that the children surprised Queen Elizabeth and Prince Philip with “personalized Easter eggs, which they made and decorated themselves.”Grandpa Charles and Step-Grandmother Camilla will probably get one of them this year.

As previously indicated, their parents host an annual Easter egg hunt in which George, Charlotte, and Louis will participate.

“It was a real treat because they don’t let George, Charlotte, and Louis have chocolate and sweets every day,” the insider told Us Weekly.

In addition to playing tennis and going on family bike excursions, George and Charlotte also enjoy taking horseback riding lessons. Charlotte shares her great-grandmother’s obsession for horses. It’s her preferred pastime.

For Kate, spending time with her kids has always been a blessing.

“She constantly says that having her family around helps her get through tough times, and the kids always make her day happier. The Us Weekly source continued, “She feels incredibly fortunate to have her children and a wonderful family.

Thus far, Prince George has not experienced any negative effects from royal news. However, it’s possible that his mother’s illness will, regrettably, be his first introduction to the responsibilities of being a member of the royal family.

According to royal analyst Sarah Vine, Kate Middleton and William are “lucky” that their kids are still “quite young,” as it would be more difficult to keep them safe from finding out about their mother’s diagnosis online if they were older.

“It’s imperative to attempt to manage the kids because they will undoubtedly have a lot of questions and it’s just really scary knowing that your mother is ill,” she said.

“Plus, kids on the playground are cruel, so it’s better that it’s not exposed to the kids on the playground just yet,” co-host Andrew Pierce continued.

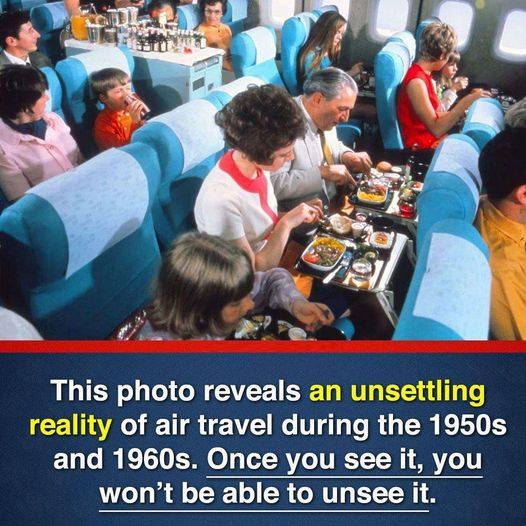

What Your Typical Day Was Like During ‘The Golden Age’ Of Commercial Flying

From the 1950s to the 1970s, flying was a luxurious experience. Aviation historian Graham M. Simons recalls it as a time of elegance, with spacious seats and stylish crew. Passengers dressed up, adding to the sense of occasion.

Flight options were limited and costly. A round-trip ticket from Chicago to Phoenix in 1955 cost $138, about $1,200 today. Aviation expert Guillaume de Syon notes that flying was four to five times more expensive than now, making it accessible only to the wealthy.

Airlines served lavish meals with delicacies like caviar and foie gras. Some even hosted fashion shows on board. Former flight attendant Suzy Smith remembers serving beluga caviar during flights.

Flying felt like a cocktail party. Passengers dressed formally, and relaxed security allowed unusual items like pet birds in shoeboxes. This freedom contributed to a laid-back atmosphere.

Pan Am epitomized luxury and glamour. Former employee Joan Policastro recalls star-studded flights with exclusive lounges.

Flight attendants had strict appearance standards, wearing high heels, white gloves, and corsets. Airlines imposed rules on appearance, hair length, weight, and marital status.

Despite its end, the Golden Age of flying is fondly remembered. Groups like World Wings, former Pan Am employees, cherish memories of when flying was an adventure synonymous with luxury and excitement.

Leave a Reply